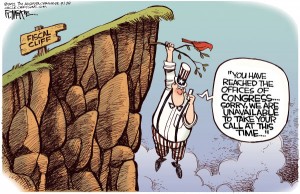

With only four days left before the “fiscal cliff” hits, Congress, President Obama, the Republican and Democratic leaders are all rushing to come to a solution for 2013 budget deficit. The “fiscal cliff”, in a nut shell, is a term used to describe the economic effects that will occur if existing laws remain unchanged regarding taxes and government spending. One group suggest higher taxes and more temporary economic stimulus spending while the other group propose to extend all of the Bush tax cuts which they claim will help fuel business growth and consumer spending as well as cut the expansion of Medicare, Medicaid and Social Security in order to curtail the deficit over time and speed economic recovery. If no deal is reached by December 31st, economists assert that the financial markets will collapse and the U.S. will go into a recession. How will this impact our lives?

With only four days left before the “fiscal cliff” hits, Congress, President Obama, the Republican and Democratic leaders are all rushing to come to a solution for 2013 budget deficit. The “fiscal cliff”, in a nut shell, is a term used to describe the economic effects that will occur if existing laws remain unchanged regarding taxes and government spending. One group suggest higher taxes and more temporary economic stimulus spending while the other group propose to extend all of the Bush tax cuts which they claim will help fuel business growth and consumer spending as well as cut the expansion of Medicare, Medicaid and Social Security in order to curtail the deficit over time and speed economic recovery. If no deal is reached by December 31st, economists assert that the financial markets will collapse and the U.S. will go into a recession. How will this impact our lives?

Policy uncertainty will drive the stock prices down, business will be too worried to hire or expand resulting in higher unemployment rates, Americans will see higher taxes and less discretionary income, government programs such as military and social programs will be severely reduced and much more negative result will occur.

Nothing good happens being in debt. It is best to get help with debt problems immediately as it could lead to severe consequences if not address properly as we can see with the U.S. debt crisis. Unlike the fiscal cliff debacle, there is debt relief available for personal finance through the help of debt settlement programs like Debt Alternative Center who support debt free causes.